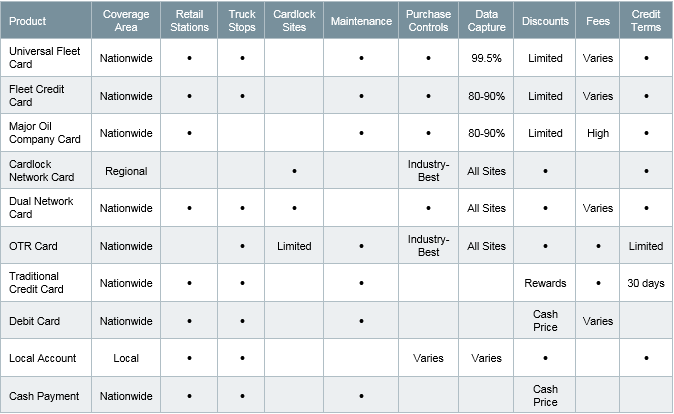

Choosing how to handle your fleet fueling needs is critical because fuel ranks as one of the highest expenses for transportation companies. Businesses have many options for procuring fuel for their vehicles, and there's no "one size fits all" solution to simplify the decision making process. It's essential to understand all of your options and evaluate based on the size of your fleet, industry, and primary needs. Below we outline the products available and provide a comprehensive chart to help you find the best fuel card and decide what's best for your business.

What's the best fuel card for your fleet?

Universal fuel cards

Universal cards, like the WEX or Voyager card, give you access to nearly every major fuel brand with acceptance upwards of 95% of all locations in the U.S. The obvious advantage is convenience with approximately 170,000 sites from which to choose. Universal fuel cards save you time and money because you they allow you to refuel anywhere and you don’t need to search for a location (or use extra fuel to get there). However, selective shopping across brands could be worthwhile. Because they aren't limited to just a single retailer, you can pick the locations with the lowest prices. Some universal cards offer discounts, but normally these are reserved for larger fleets. You should also verify if additional fees will apply.

In addition to fuel products, you can authorize your cards to pay for maintenance if a vehicle breaks down or needs service. There are approximately 60,000 maintenance locations in the U.S. from which to choose. Not only do you benefit from broad acceptance, you can consolidate vehicle fuel and maintenance expenses onto a single payment platform, making the oversight of driver purchases easier.

Universal cards are PIN-protected and can be tied to a driver or vehicle. You can set cards to limit the dollars per transaction and number of transactions per day, week or month; restrict fueling to certain times of day and days of the week; and prompt cardholders to enter driver or vehicle identification as well as odometer and/or job number at the time of fueling. Level III data is captured at 99.5% of sites so that you know the card number, dollar amount, gallons, fuel type, date, time and location for each purchase.

Universal cards are often the best fuel cards for fleets that prioritize convenience for their drivers and want to limit purchases to fuel or fuel and maintenance.

Pros: Universal acceptance, optional maintenance, Level III data

Cons: Limited discounts

Fuel credit cards

Fuel credit cards are affiliated with Visa or MasterCard, which is why their logos appear on the cards. Unlike traditional credit cards, merchant acceptance is limited to gas stations, intended only for fuel and maintenance purchases. Purchase controls are available to help you prevent driver abuse, but they might not be as comprehensive as the controls with other card products. Like universal cards, discounts are generally for larger volume fleets.

Fuel credit cards can be assigned by driver or vehicle and can capture level III data, something not available with regular credit cards. This allows you to know the card number, dollar amount, gallons, fuel type, date, time and location for each purchase. The more information available, the easier it is to identify suspect activity.

The main concern with this option is that additional data is not always captured. Because these are processed like traditional credit cards, they’re limited by the credit card systems and software at stations, something that doesn’t affect other card products that are processed differently. Some industry estimates suggest that the equipment and software upgrades needed to capture data, beyond just the transaction dollar amount, is unavailable at anywhere from 10% to 20% of gas stations. Because data capture is one of the most important aspects of fueling programs, this could be a significant issue. Even assuming only 10% of stations lack the proper equipment and software, that means approximately 17,000 sites nationwide are non-compliant. If your drivers fuel at those locations, there can be a gap in transaction details, making it harder to account for usage and increasing the risk of fraud.

Fuel credit cards are the best fuel cards for fleets that need convenience for their drivers and want to allow business purchases in addition to fuel and maintenance.

Pros: Universal acceptance, optional maintenance, Level III data

Cons: Limited discounts, limited data capture at 10%-20% of sites

Major oil company gas cards

Major oil company gas cards are supplied by retail chains, such as Mobil, Chevron, Shell, and others. Acceptance is either limited to one brand or a broader selection, much like a fuel credit card. These cards draw interest because of the rebates and discounts that are advertised. However, the terms and conditions of the account often stipulate that you must a) purchase a minimum amount before a rebate or discount takes effect, and b) the rebate or discount applied is capped up to a certain amount. After hitting the capped amount, your price reverts to a non-discounted rate.

Most major oil company gas cards only offer a rebate or discount when fueling occurs at their branded sites. The goal is to keep your purchases within a brand’s network of gas stations, which is problematic when competing brands offer a lower price. Moreover, these cards often apply extra fees unrelated to your fuel purchase. These can include ongoing account administration fees, monthly fees per card, late fees and fees for your method of invoice payment. These extra fees can add up and completely negate the rebate or discount that was advertised.

Pros: Rebates or discounts (for qualifying purchases up to a limited amount)

Cons: Extra fees offset rebates and discounts

Cardlock network cards

Cardlock Network Cards, such as CFN and Pacific Pride, give you access to locations intended primarily for commercial fleets as opposed to the general public. The majority of fuel locations are commercial sites, or cardlocks, designed for larger vehicles and located near major industrial areas and highways. The purpose is to enable drivers to get vehicles into sites easily, refuel quickly and get back on the road. Amenities often include high-speed dispensers with satellites, wider lanes without truck restrictions and 24 hour access to accommodate drivers around the clock. While the number of cardlocks is limited, especially when compared to the number of gas stations in the U.S., cardlock networks include thousands of locations to accommodate regional and some nationwide fleets.

Besides the site design for larger vehicles, companies select cardlock network cards because of the discounts and purchase controls available. Cardlock cards generally offer cost-plus pricing that discounts your cost per gallon. Pricing and fees vary by card issuer, although some vendors charge no fees. Discounted rates can vary by customer volume but are ongoing, rather than capped amounts experienced with other card products.

Cardlock cards are PIN-protected and offer industry-best purchase controls. You can limit the gallons per transaction based on vehicle fuel tank capacity and the number of transactions per day. Hard controls are available to restrict fuel types (e.g., diesel only), reducing the risk that your drivers purchase fuel for personal use. Fueling can be restricted to certain times of day and days of the week to prevent abuse. Drivers can be prompted to input driver or vehicle identification, odometer and job number. Unlike the data issues you can experience with credit cards, cardlock network cards capture Level III data from all fuel locations. That means you know not only the amount purchased, but when and where the card was used, the gallons and fuel type that the driver purchased, and the vehicle that was fueled.

These cards are often the best fuel cards for truck fleets that operate on the West Coast and need access to sites with easy access for large vehicles.

Pros: Discount pricing, industry-best controls, Level III data

Cons: Limited number of sites, maintenance unavailable

Cardlock network cards with retail access

In order to accommodate companies that prefer using a cardlock fuel network, but need extended coverage for when those locations are not convenient, some cardlock cards have additional retail access. One such example is the the CFN Fleetwide fuel card. As a result, these cards are accepted at select retail gas stations and truck stops in addition to commercial fuel locations. That dual acceptance provides you the flexibility of either fuel network depending upon cost and location.

This program offers discounts at cardlocks just like you would receive if you used a traditional cardlock network card. The difference, however, is that discounts are not usually available at retail stations and truck stops that are not part of the cardlock network. Some cards might include additional fees at retail locations, which is why companies often direct drivers to fuel at commercial locations whenever possible.

The purchase controls available with these cards are as robust as those with cardlock network cards when drivers fuel at cardlocks. The exception occurs when fueling takes place at extended retail sites and truck stops. At those sites, the ability to limit fuel type is unavailable since all fuel products are authorized at the pump when drivers use a valid card and PIN. Regardless of the site, purchase controls to limit transactions and days and times are available, which makes dual network cards more secure than most card products. Also, level III data is captured for every transaction, regardless of where drivers fuel.

Pros: Discount pricing (at cardlocks), industry-best controls (at cardlocks), Level III data

Cons: Less product control at retail sites, maintenance unavailable

Over-the-road fuel cards

Over-the-road cards (OTR cards) are best suited for companies engaged in long-haul trucking over the road, hence the card description. OTR cards are accepted at a majority of truck stops, including major brands and independents (acceptance can vary), but the overall number of locations is actually much less compared with other card products. If you operate regionally with few nearby truck stops, that could create a coverage problem for you. For companies that pass through major trucking corridors regularly, the fewer number of fuel locations is less an issue.

OTR cards can offer competitive rates at truck stops, making them an attractive option for many companies. Discounts are often available because of the sizable transaction amounts that occur when fueling tractor-trailers and competition amongst truck stop chains to drive volume to their sites. While this discounted pricing can be beneficial, you should be aware of additional fees that can apply.

Vendors that issue OTR cards often charge transaction fees with each purchase. In most cases, these transaction fees are fixed amounts regardless of transaction size. That’s good news when the fee is spread across a large number of gallons, but when customers purchase fewer gallons, the transaction fee has a greater impact on the overall price per gallon. For example, if you purchase 200 gallons of diesel fuel and pay $2.00 per transaction, that fee raises the price per gallon by $0.01. But if you were to purchase 50 gallons a $2.00 transaction fee raises the price per gallon by $0.04. Depending upon the fuel discount being offered, the transaction fee could outweigh any savings. And because profit margins for OTR card vendors can be modest, the amount of credit provided to you could be low, resulting in shorter terms and more frequent payments to avoid hitting your credit limit.

OTR cards offer driver services that most card products do not. Many OTR cards provide drivers access to showers or lodging and can even be used for cash advances, tolls and lumper payments. While not all companies will make use of such options, their availability can be convenient.

OTR cards are the best fuel cards for trucking companies that operate across the country and stay on major highways.

Pros: Discounts, driver services

Cons: Limited number of sites, transaction fees, shorter credit terms

The best fuel card company.

After determining the best fuel card for your fleet, you will have to find the best vendor that provides that type of card. For some card types above, there are only one or two providers while others will have many. Read our blog on finding the best fuel card company for your business.

The best payment options other than fuel cards

Traditional credit cards

Some companies choose to issue traditional credit cards to their drivers to pay for fuel, among other expenses. And that’s the key distinction: an ongoing need to pay for items besides fuel. Because if you are looking to control driver purchases, a traditional credit card is an ineffective solution.

Though widely accepted and a convenient form of payment, credit cards are not PIN-protected and offer few safeguards, if any, against theft. Fueling data is limited to the merchant name and purchase amount. Additional information regarding driver, vehicle, odometer, gallons and fuel type is unavailable which makes effective monitoring of fuel purchases nearly impossible. In most cases, companies that use traditional credit cards require receipts to be submitted for each purchase, creating more work for drivers and management.

There are some advantages with traditional credit cards that aren’t available with other card products. Many credit cards offer rewards programs to incentivize spending, and some business owners prioritize those incentives. Credit cards usually offer you longer payment terms than other card products. The downside is that credit card companies charge finance fees in exchange for longer payment terms.

Pros: Universal acceptance, rewards, longer credit terms

Cons: Finance fees, no purchase controls, no data capture

Debit cards

Like traditional credit cards, debit cards are a widely accepted and convenient form of payment, and some companies use them to pre-fund driver expenses. That might be a simple way to limit the overall amount your drivers can spend, but debit cards have no controls for restricting how your funds are used, making cardholder abuse more likely than with other card products. And because data is limited to only the merchant name and purchase amount, management may require receipts to be submitted to fully review exactly what was purchased.

Some locations will offer you a cash price if you use a debit card, although some retail chains do charge a transaction fee even if you use a debit card. When compared with traditional credit cards, debit cards do offer a slight advantage in that a PIN is required prior to purchase. However, the main drawback with debit cards is that funds are withdrawn immediately from your bank account, meaning no credit terms are available. The lack of credit terms could significantly impact your company’s cash flow.

Pros: Universal acceptance

Cons: No purchase controls, no data capture, no credit terms

Local fuel accounts

Local fuel accounts are not a card-based solution, but many companies set up house accounts with a local gas station. Agreements with stations can vary, but some will offer you discounted pricing. The transaction process usually involves a station attendant checking a driver name or vehicle number against a list you provide. The attendant then activates the pump and records the transaction, often manually, which is more prone to error than a card-based transaction.

Part of the rationale for a local account is that by restricting drivers to one location, the chance of fraud should decrease. It might not be that easy. Controlling the transaction is entirely dependent upon the station attendant’s training and attention to detail. Your fuel policy could easily go unenforced if an attendant either misunderstands or ignores which drivers are allowed to fuel which vehicles and by how much. There are no automated transaction limits like there are with most card products, and relaying when purchases are made is a manual process. For house accounts, driver transactions are usually only conveyed when an invoice is issued to you, whereas most card products include online access so that you can review transactions almost immediately.

The obvious disadvantage with a local account is that fueling can only occur at one station. That could increase driver fueling time when the station is busy. The locale might be convenient for your current routes, but as your business grows, the need for more locations might become an issue. Many businesses simply set up additional house accounts with other stations, but they end up unnecessarily multiplying their number of vendors when a card-based solution would be more effective.

Pros: Discounts, restrict driver fueling to known site

Cons: Only one site available, controls and data capture depend on attendant

Cash payments for fuel

The risk of using cash to pay for fuel well outweighs the benefits. It’s mostly true that “cash is king” when it comes to fuel prices. Many locations offer a cash price that differs from the price available using other forms of payment. The difference in price could be substantial, but so is the risk.

Most business owners would agree that handing cash to drivers is not ideal. There is inherent risk to the driver having to secure large sums of money while on the road, and transactions often take longer since cash payments require in-store transactions as opposed to paying at the pump. There are no controls for how your cash is used, and your data is limited to what is printed on the station receipt. If a receipt is lost, there is no record of the purchase and no online database from which you can audit purchases. Cash payments create a labor intensive process that requires you to constantly audit what amounts were issued to which drivers for what purposes. And the most obvious issue with paying cash is that it impacts your cash flow; there are no credit terms.

Pros: Discounts

Cons: Highest risk of theft, no controls, no data capture, no credit terms

Product comparison

Conclusion

Choosing the best fuel card for your fleet takes much consideration to get the right combination of convenience, purchase controls, data capture, discounts/fees and terms. This comparison will help with your decision making process.